How Criminals' Most Favored Currency Became A 'Trump Trade'

By now it’s obvious that Donald Trump suffers from CBS — Cowardly Bully Syndrome.

On Friday, Trump blasted China’s new export controls on rare earths, declaring them a “moral disgrace” which were “obviously a plan devised by them years ago.” And he threatened to impose 100 percent tariffs on China, on top of the already high existing tariffs.

Less than a day later he was groveling:

So it only took a few hours to go from “a plan devised by them years ago” to they “just had a bad moment,” from “moral disgrace” to “highly respected President Xi.” The Chinese must be having a good laugh: They took Trump’s measure and he came out looking very, very small.

But what caused this quick, abject retreat? I’d like to believe that economic experts within the administration took a sober look at the situation and concluded that China would have the upper hand in a trade war. But there are no economic experts in this administration, and anyway, who would dare to tell Trump anything he doesn’t want to hear?

No, Trump was almost certainly reacting to the markets. Stocks fell sharply Friday, but the really striking action came in crypto, where Bitcoin fell 20 percent and smaller, less liquid tokens fell even more. Here, to take an arbitrary example, is what happened to the value of the official Trump coin:

Also, it just so happens that Trump himself holds an estimated $870 million worth of Bitcoin, so he suffered large personal financial losses from the crypto crash.

This was the largest one-day crash crypto has experienced so far. My question, however, is why the prospect of an intensified trade war caused a crypto crash.

Oddly, I’ve seen almost no reporting about this issue. There has been a lot about the way the crypto crash was magnified by forced sales: Many crypto investors are highly leveraged, and there were many forced liquidations — with widespread speculation that one or more “whales,” that is, major players, may have imploded. But why did a threatened trade war cause crypto to fall in the first place?

The answer, I believe, has little to do with economics and everything to do with politics. These days crypto derives its value largely from the support of politicians and government officials — in particular, officials who can be bribed. As a result, at this point crypto is largely a Trump trade. And crypto fell because the backlash against the potential trade war threatened to weaken Trump politically.

A brief history of crypto: When Bitcoin, the original crypto asset, was introduced, enthusiasts predicted that it would displace conventional fiat money, that is, currency issued by governments. The blockchain, they claimed, would make transactions using cryptocurrency easier and cheaper than transactions using dollars. And cryptocurrencies would be safe from the ravages of the printing press: governments couldn’t debase your money through inflation.

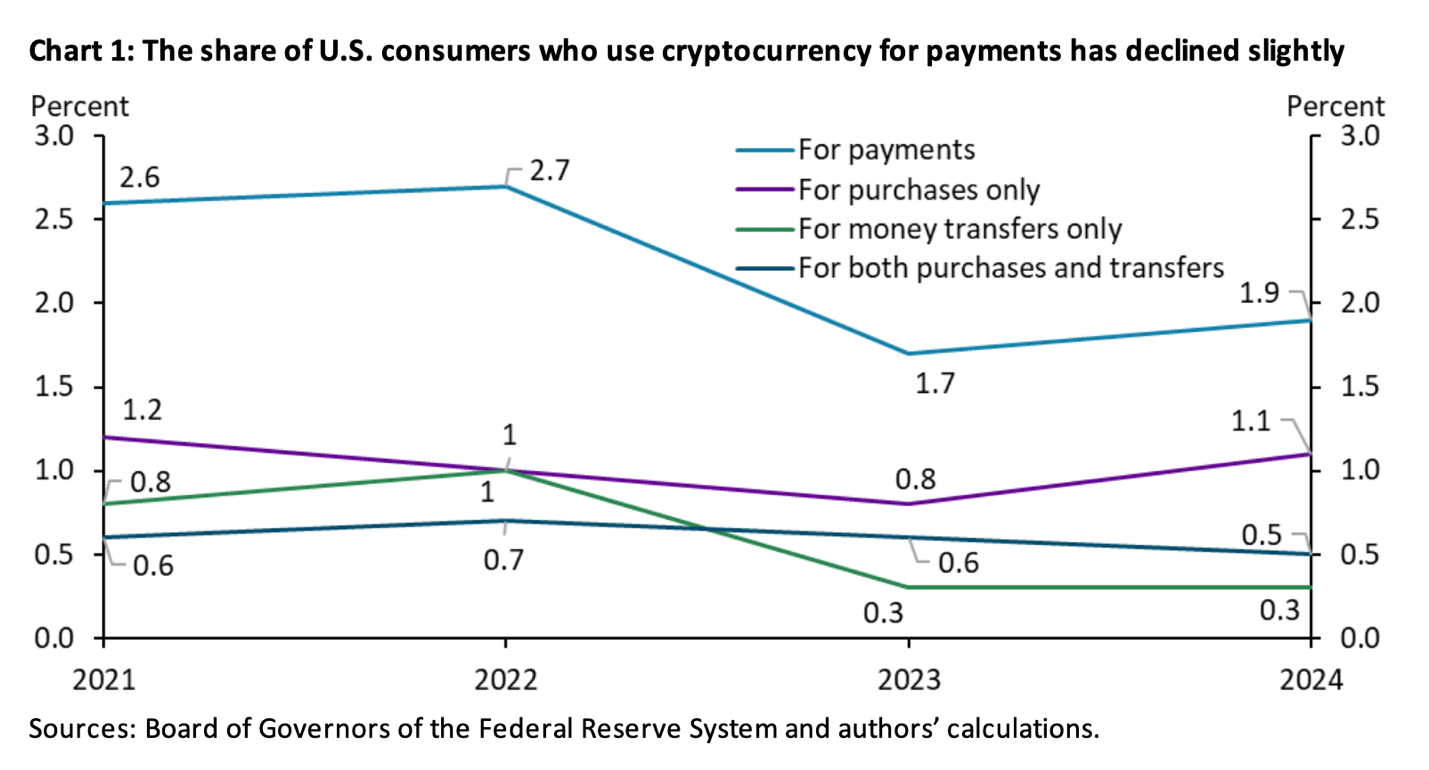

That was more than 15 years ago, and crypto has completely failed to deliver on those promises. Almost nobody uses cryptocurrency as a means of payment. A recent research paper from the Federal Reserve Bank of Kansas City notes that

The share of U.S. consumers who report using cryptocurrency for payments—purchases, money transfers, or both—has been very small and has declined slightly in recent years.

Here’s the chart. The blue line at the top shows the percentage of consumers using crypto for any kind of payment:

Yet the public holds roughly $4 trillion in crypto assets. Why? Largely as a pure speculative investment. In addition, however, crypto has found real-world use as a convenient tool for criminal activity and money-laundering. In fact, that Kansas City Fed paper noted that the most important reason people gave for paying in crypto was “person or business receiving the money preferred cryptocurrency.” It’s not a stretch to imagine that the reason for that preference was often the desire to hide the payment from the authorities.

As for the vision of a private currency insulated from government, at this point the biggest factor supporting the prices of Bitcoin and other cryptocurrencies has become the belief that Donald Trump — whose family has made billions from crypto sales, and whose party received hundreds of millions in crypto campaign contributions — will promote the industry. No pesky regulations that might limit the financial risks from stablecoins. No serious efforts to limit the use of crypto to facilitate criminal activity.

And Trump has declared his intention to create a “strategic crypto reserve.” True, this reserve will supposedly come out of crypto seized from criminals. But it would still support crypto by keeping those tokens off the market.

The prospect of high-level political support is why the prices of Bitcoin and other tokens surged when Trump won in November. As I said, at this point Bitcoin is basically a Trump trade, since it’s hard to imagine Democrats being remotely as favorable to the industry.

In the past I’ve described the case for Bitcoin as being a combination of technobabble and libertarian derp. My view about the technobabble hasn’t changed. But I will amend the case against crypto by adding that the crypto industry is one of the prime beneficiaries from a new regime of crony capitalism, in which an industry’s success depends on its ability and willingness to bribe the right people.

So why did Trump’s threat of all-out trade war with China cause crypto prices to plunge? Not because the economic damage from such a war would reduce the use of crypto, because crypto basically doesn’t have any legitimate uses. But an intensified trade war, especially a trade war America would almost surely lose, would drive Trump’s public support into an even deeper hole. And this would reduce the ability of history’s most corrupt administration to keep showering favors on the industry that made Trump rich.

Paul Krugman is a Nobel Prize-winning economist and former professor at MIT and Princeton who now teaches at the City University of New York's Graduate Center. From 2000 to 2024, he wrote a column for The New York Times. Please consider subscribing to his Substack.

Reprinted with permission from Paul Krugman.